Renters Insurance in and around Dallas

Get renters insurance in Dallas

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

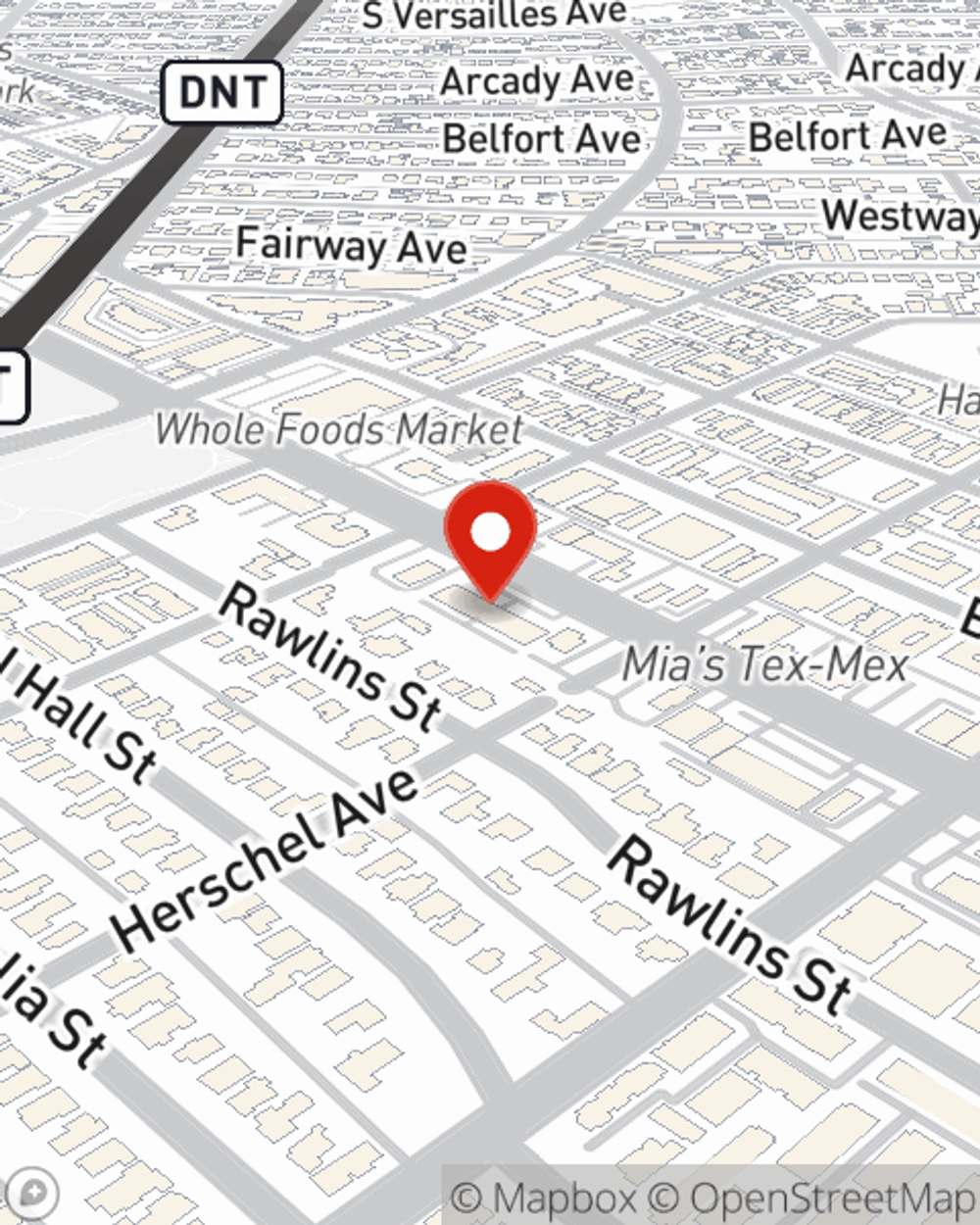

Renting a home comes with plenty of worries. You want to make sure what you own is protected in the event of some unexpected trouble or loss. And you also need liability protection for friends or visitors who might hurt themselves on your property. State Farm Agent Scott Beseda is ready to help you handle the unexpected with dependable coverage for your renters insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Scott Beseda can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Get renters insurance in Dallas

Renting a home? Insure what you own.

There's No Place Like Home

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects your precious belongings with coverage. If your rental is affected by a break-in or a burglary, some of your possessions may have damage. If your belongings are not insured, the cost of replacing your items could fall on you. It's scary to think that in one moment, the unexpected could wipe out all you've invested in. Despite all that could go wrong, State Farm Agent Scott Beseda is ready to help.Scott Beseda can help offer options for the level of coverage you have in mind. You can even include protection for valuables when they are outside of your home. For example, if your personal property is damaged by a fire, your car is stolen with your computer inside it or your bicycle is stolen from work, Agent Scott Beseda can be there to help you submit your claim and help your life go right again.

Reach out to State Farm Agent Scott Beseda today to discover how the leading provider of renters insurance can protect your possessions here in Dallas, TX.

Have More Questions About Renters Insurance?

Call Scott at (214) 219-6610 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Scott Beseda

State Farm® Insurance AgentSimple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.